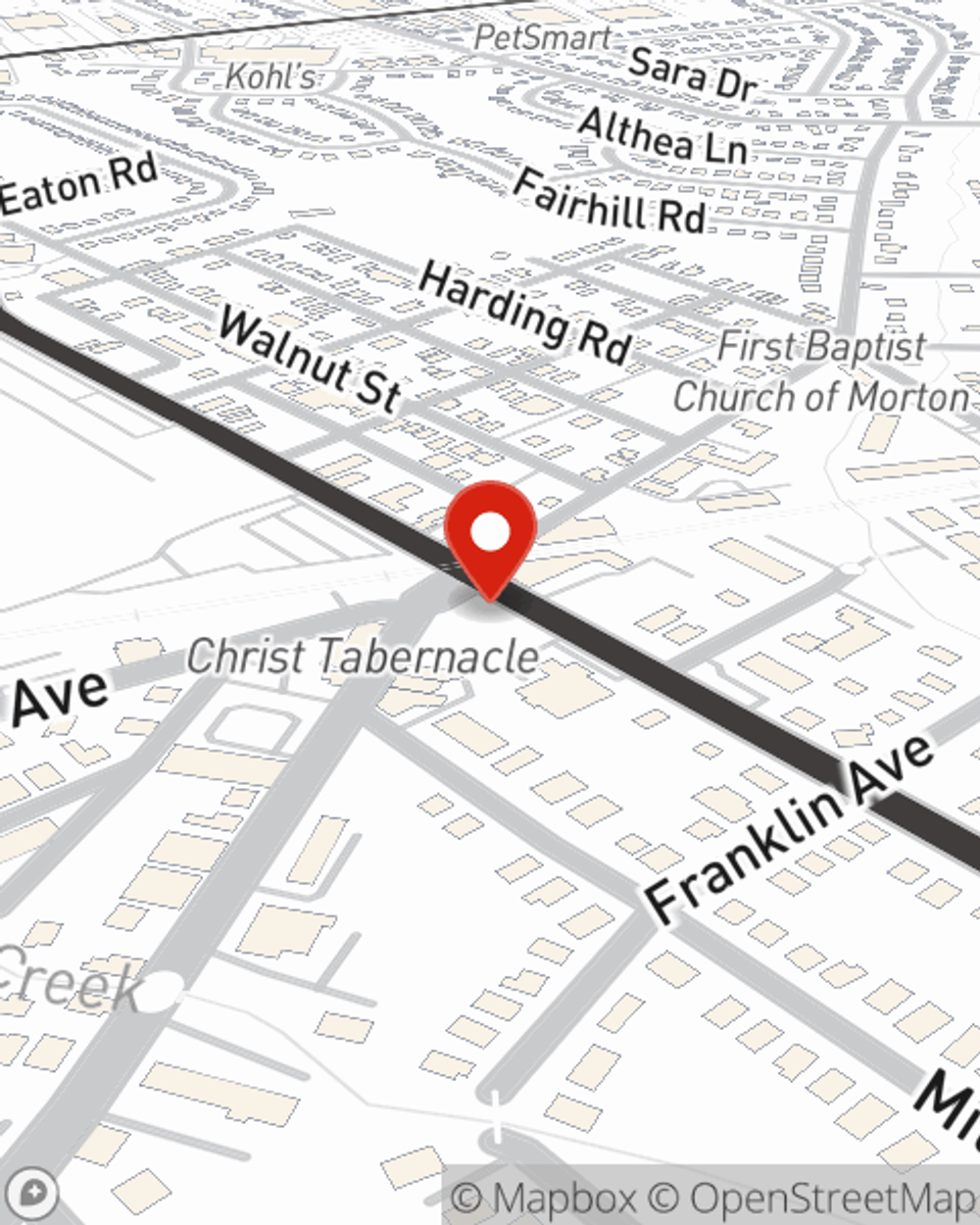

Business Insurance in and around Morton

Calling all small business owners of Morton!

Helping insure small businesses since 1935

- Morton PA

- Springfield PA

- Media PA

- Prospect Park PA

- Delaware County PA

- Philadelphia PA

- Norwood PA

- Ridley Park PA

- Swarthmore PA

- Dary PA

- Drexel Hill PA

- Ashton PA

- Folsom PA

- Folcroft PA

- Holmes PA

- Sharon Hill PA

- Glenolden PA

- Clifton Heights PA

- Lansdowne PA

- Brookhaven PA

- Broomall PA

- Havertown PA

- Wynnewood PA

- Wallingford PA

Your Search For Great Small Business Insurance Ends Now.

You've put a lot of resources into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a fabric store, a hearing aid store, an art gallery, or other.

Calling all small business owners of Morton!

Helping insure small businesses since 1935

Get Down To Business With State Farm

Your business thrives off your commitment creativity, and having dependable coverage with State Farm. While you support your customers and do what you love, let State Farm do their part in supporting you with business owners policies, artisan and service contractors policies and commercial liability umbrella policies.

Let's review your business! Call Derek Jones today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Derek Jones

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.